Housatonic Students Balance Finances and Academics

One of the biggest obstacles that can disrupt the academic process for Housatonic students is finances. Many students have to work long hours outside of school to be able to afford to have a place to live, food to eat and emergency savings. Some even work multiple jobs! All of this can be very distracting for students who have to balance their professional career, academic careers and their finances. While ideally students’ main focus in their lives would be school, it simply isn’t possible for many.

Connecticut has one of the highest costs of living in the United States and a minimum wage of $9.60 per hour, a number that is almost half the $19.08 per hour living wage. A living wage is the amount a worker would have to make working forty hours a week in order to pay rent and afford food every week. Students who wish to still go to school full-time (a requirement to get the full amount of FAFSA available to them) can have difficulty scheduling forty hours of work around their academic careers, making the living wage a higher one for them. Since Connecticut’s unemployment rate of over 5%, many students may also have trouble finding a job in the first place.

Alana Wiens, program director for the Family Economic Security Program (FESP) at HCC, gave an example of how this can affect a student’s academic process. “You know when your car breaks down and you don’t have the $400 to fix it. It means you are not going to get class while the car is not working. It’s tough.”

While this is a very difficult and real situation for many Housatonic students, there are things students can do and resources available they may not be aware of. FESP provides support for students who are financially independent and many times are supporting families of their own. Achievement coaching, career services and financial coaching are some of the offered services. Widelyne Dorelus, the Career Development Coordinator for FESP, explained what she helps students with: “I work on a [student’s] resume to see who I can connect with: employers, people in the community, people at the college, to see what available possibilities there are to get them a job.”

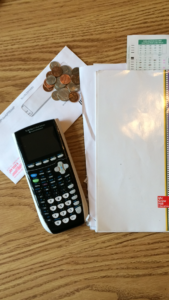

But what can students do right now to afford to pay their bills and go to school? Professor Mary Vlahac suggests that students should develop a “spending plan” and “live below their means” and cut non-essential costs in order to be able to pay bills.

“Put together your spending plan more than anything else. What are your fixed expenses? You have to put all that into your spending plan and divide it up… you have to get to the basics of what you really need and that is what you can afford,” she said.

Vlahac says that students should plan ahead now for their life after Housatonic by starting to invest for retirement now as well as regularly checking their credit.

Wiens suggests that one way students can plan for their careers after Housatonic is by using ONet, a Department of Labor sponsored website that shows the median salary and education requirements for varying degree paths (https://www.onetonline.org/).

Dorelus explains, “A big part of it is being realistic. I think for a lot of students there is something missing there. ‘Yeah I get a paycheck and I’m going to go rent an apartment just because’ opposed to ‘I get a paycheck, will it be enough to take care myself, all my bills, will I have food? Will I be able to put gas in my car to get to school or get to work or my internship or whatever it may be. Students are missing that middle piece.”

More information on FESP and the resources they provide can be found by contacting Weins at [email protected] or by going to the FESP office at Lafayette Hall room B104.