The Catch 22: Getting a Job to Afford School So You Can Get a Job

Ever since we started school students have told that we have to go to school to get a good job and make more money. Now that we’re in college we have to work bad jobs that often distract us from our academics to be able afford school and eventually enter a job market that is anything but promising.

Last semester I wrote an article for the Horizons website about the tough financial situations that students face when trying to go to school full-time and work enough to support themselves. It was one of the most frustrating pieces of writing I’ve done.

While researching for the article I quickly found out there was no easy solution to the financial issues we face, but we can do better. The school can do more for students to prepare us, students can do more to prepare, and the structure of classes could be changed to be more understanding to students working and going to school full-time.

My first semester at HCC, school was my only responsibility. I didn’t have a job, so I was able to spend all the time necessary on writing papers, studying for tests and finishing all my assignments on time and I finished the semester with good grades..

Around the time of my second semester I started a new job. I started to realize that working and going to school full-time was going to be a struggle. I had to start pulling all-nighters to finish assignments that wouldn’t have caused me any sleep-deprivation before I was working. I had to learn to balance my schoolwork and my job. Sometimes that meant compromising on the quality of my school work, and it showed in my grades.

So why would anyone choose to put themselves through the struggles of working and going to school full time ? The answer is simply: we have to do it.

In Fairfield County, according to a study by MIT, the living wage – the per hour wage that would be required to afford food,rent and utilities with 40 hours of work – is $13.48 for a single adult. This number is in stark contrast to the minimum wage of $9.15. Most HCC students have no other option than work long hours in order to afford food and shelter. We are almost forced to get a job that many times pays low wages because even some of the most financially prepared students are one bad situation from getting stuck in this trap.

There is no easy fix for this catch 22.

There will never be a time where every student can focus only on school without concern for their finances. Gowever, there are some steps the educational systems and students could be making in order to prepare and inform students about this problem.

According to a study by Money Matters, financial literacy among college students is on the decline and that only 1 in 10 students feel prepared to pay off their student debts.

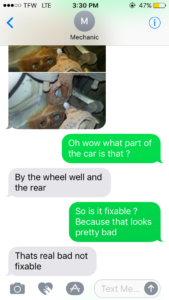

Since my last article HCC Business Professor Mary-Ann Vlahac has started a Personal Finance course that focuses on “ setting financial goals, implementing plans to achieve those goals, and measuring financial health.” These are all skills that are sorely needed for students and financial education is a key step. However, all it takes is one layoff, a car breaking down or any of the many things that can cause students living paycheck to paycheck to fall behind.

A step that the school to take to help this is creating more student jobs on campus. Getting a student job could go a long way towards helping students gain financial security. They eliminate a commute, give students peace of mind from layoffs and can work with student’s class schedules in a way outside jobs can’t. It’s unrealistic for every student to get a campus job, but every working student can demand more from their current job. A higher minimum wage and more lenient hours are just a few of the things that could improve the living quality of working students.

We can’t fix this, but we can work on it.